Your First Sales Hire

Your First Sales Hire

(Especially if you’re bringing something new to the market.)

When you do something long enough, you notice patterns. Having spent 13+ years working with B2B companies to grow sales, there are several patterns that have become predictable.

The early-stage company struggling to nail their first 1-2 sales hires might as well be a rite of passage for founders and business owners.

Here’s what it sounds like: “We/I have hired this person to…..

- “Make cold calls to set meetings”

- “Open up this market”

- “Handle our inbound leads”

- “Take these deals and run with them”

- “Introduce us into his/her network”

Followed by this: “But…..

- “They don’t seem to get it”

- “They need me to do everything”

- “They can demo, but not much else”

- “They bring me into all the meetings”

- “I have to close all the deals”

- “The meetings aren’t there”

- “They don’t handle leads the way I would”

- “They give up after token resistance”

- “If the prospect doesn’t answer ‘Yes’ to an early question, they don’t know what to do”

These owners and founders, who have been the lead salesperson up to this point (and usually after) usually undervalue their unconscious competence. And that’s where the problems begin.

When it comes to handing off sales, owners aren’t handing off their books or accounting. Or IT. Or anything where there’s an agreed-upon body of knowledge that qualifies a person to do the job well.

Often, a founder has been figuring out how to sell their product or service on the fly. Especially if they’re bringing a new concept, service, or product to the market. There’s no playbook. The founder has been figuring it out along the way, storing experiences and lessons in various parts of their memory, all for later use. The founder/owner iterates constantly. They have to in order to survive.

And they forget the fluid nature of the sale when they go to make that hire.

They do know they can’t do this forever and grow their company. They need a salesperson to take some work off their hands. So what do they do?

They talk to friends about their experience with salespeople, which is usually incompatible as an experience.

They may consult books on how to hire a salesperson and buy into some nonsense like, “Hire someone competitive,” or “Look for work ethic and internal motivation.” Which helps no one. No founder thought, “I should hire a guy I have to beat to get out of bed each day.”

Or they look at successful companies and decide to poach their people. Which is often worse than the prior two options because advantages at one firm don’t always translate to yours.

And all miss something important, something that the founder-owner forgets about their sales experience and their market.

Here, we’ll lay out options founder-owners go through in looking for a sales hire, why they fall in love with those, and all the reasons they’re wrong. Then we’ll give you another, more workable path that requires more effort but less cash burn. Ready?

Here’s who typically gets hired.

- The rep who has done the job somewhere else and apparently had success. This is often seen in more mature industries, though startups bringing new concepts to market do this, too. They look for someone who has prospected. Who has built campaigns. Who has sold something somewhat similar.

- Why this is attractive: Most of us take mental shortcuts in making decisions. We’d collapse from exhaustion if we didn’t. So we look at people who have held a role that we believe is similar to the one we’ve got open, and if this person can evidence (or not) some modicum of success, we believe, “Why not with my company?” Especially when founder-owners are Ted Lasso-like in their optimism.

- Why this breaks hearts: There’s a flawed assumption when we believe that because someone has done something before, that they can and will do it again, in a different environment, with different resources, in a different market with a different product or service. Appointment setters who once did it in the early 2000s may not be able to handle the changes that have occurred with buyers. Perhaps the woman who sold well for big company A when it was young and growing had advantages she didn’t understand that aren’t available at your company. The reasons are many. Someone who has done something similar before may be necessary, but it’s not sufficient.

- The senior sales exec. The guy who has been there, done that, seen it all. Maybe he owned a business. Maybe he was an exec in an ancillary industry. One thing is for sure – he can sell you on hiring him to open doors and get meetings.

- Why this is attractive: This guy has been around a while? Had success? People like him? Of course he can sell, right? He wouldn’t have made it this far without being really good. And if he can open doors, people will clearly buy. And we don’t have to teach him anything. Easy to hand the whole pipeline over.

- Why this breaks hearts: See the comment earlier. Most founders undervalue unconscious competence. They’ve been learning how to sell their company for a long time, and if they hadn’t, they’d be out of business. Now someone who may have had serious advantages elsewhere (case studies, marketing help, a market ready to buy) doesn’t have them.

- The woman who has industry experience and knows people. She made a lot of money at a company earlier. And of course whenever someone makes a lot of money, they are good, right? She has been to the trade shows and conferences. She can talk the talk.

- Why this is attractive: We don’t have to train her! And like the senior sales exec, of course she can open doors! And if doors open, deals will close, right? Her industry experience means she can connect to the needs of the prospect. Heck, she may even see new applications for our product.

- Why this breaks hearts: See the senior sales exec. Or the fact that prior success in sales too rarely predicts future wins. Can she prospect if leads aren’t rolling in? Can she get to people outside her network? Does she have a plan for dealing with prospects who don’t get what you do? She often isn’t able to pivot from a legacy product the market knows how to buy to something new and different.

- The young guy, who usually came from a F500 company. Probably was an athlete in college. He’s hungry, hard working, eager. He has been trained in a good system at a company that can afford to train people.

- Why this is attractive: His energy and desire look, feel, and sound a lot like the founder’s. The willingness to do what it takes to succeed give a founder hope that those traits, which he knows so well in himself, will compensate for a lack of knowledge, skill, or other experiences. And the founder thinks, “This guy can grow with us. Maybe become our VP of Sales one day.” It makes for a great, heart-warming story.

- Why this breaks hearts: The great thing about F500 companies is that they are typically on their 19th edition of their sales playbook. They can rehearse and train every scenario, because they know them. This guy or gal can run a route and catch a ball. They aren’t ready yet to play quarterback, especially when a play breaks down. There’s too much ambiguity. So they’re lost when a prospect goes off-script.

- The commission-only seller who is in the market but doing something else. I find it astounding people still try this route, given the misalignment of incentives, but it happens. I hear about it all the time.

- Why this is attractive: Because sometimes founders are cheap. Or cash-strapped. And they’re hoping they’ll get lucky without any time or money invested. It’s pretty simple.

- Why this breaks hearts: How often do you see things work out where there’s 0 effort invested and 0 money put in?

Here’s My Big Caveat: Anyone reading this knows of one person who has hired one of the above people and had a lot of success. It. Does. Happen. Just too rarely to bank your company’s revenue on it.

Founder-owners hire these people because they are seeking some of the following qualities when they hire:

- Experience selling

- Industry experience

- Knowledge of a system, usually from a big, established company

- Perhaps educational pedigree

- Energy or desire

All are fine, in theory.

A founder-owner wants someone who knows how to sell. This is the functional knowledge that’s needed, though few people help a founder parse which skills and aptitudes the seller needs.

Ideally, they have industry experience. Maybe even contacts. This is usually because the owner doesn’t “want to spend so much time training him/her.” (Sounds great in theory. Until they realize they’re going to have to train, anyway.)

Perhaps they can bring some knowledge of how to build the infrastructure, processes, or policies. (Though if you’re early or small, too often these aren’t much help; what a F500 does rarely applies to a company with 5 or 10 or 20 or 50 people.)

Finding intelligent people is a must, especially early on in the company’s life cycle. Though the degree they carry rarely matters much. (There, it’s been said.)

And energy and desire are hugely important when there’s a heavy lift on the horizon.

But those are insufficient.

Let’s look, instead, at what a founder needs in that early hire.

A little background on salespeople.

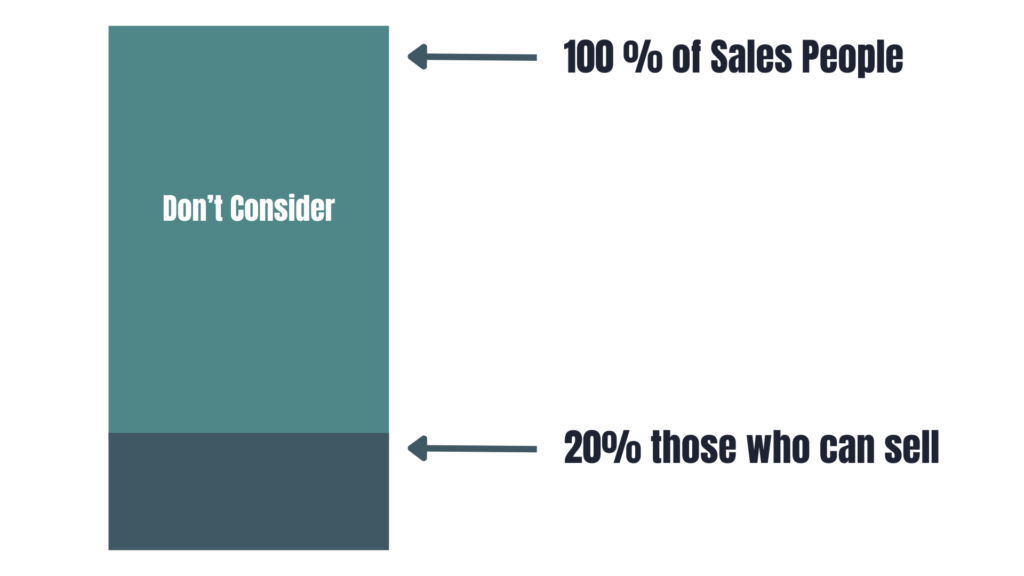

Dave Kurlan has been assessing salespeople for at least 30 years. He’s looked at over 1 million reps, and he’s concluded that roughly 20% are “serviceable” for a sales role. Makes sense if you consider the Pareto principle. Or ever look at a sales team’s production. That means 80% of the market just can’t get it done consistently.

Here’s an infographic on this.

Ok. So you’re down to the 20% of those salespeople who can sell. Not too bad. Large enough number to work with, especially in a country of 350 million people.

But here’s the problem. More than likely, in an early stage company without a slush fund to throw at the problem, this person needs to be worth more (shh…. don’t tell anyone that) than you are paying them. Meaning, you may not have a nine person SDR team with 5 account execs, a sales ops manager, and a marketing team of 5. This person, in B2B sales, probably needs to create some leads.

Ruh-roh.

Let’s lay some truth down. Most people don’t want to do this, and even if they did, they can’t. It’s rare to find someone persist in finding opportunities inside an enterprise sale. So many places to start. It’s rare to find someone who can push past the 3rd and 4th rejection.

Don’t believe me? Start asking other business owners how well their salespeople prospect. If they say, “They’re good,” ask, “Compared to you (the owner)?” It’s hard work. It involves a lot of failure and rejection. I. Hear. This. Story. Every. Meeting. I. Have.

“They say they need more leads.” “They want more marketing help.” “They say our marketing is no good.” “They need someone to get them in the door.”

So now you have another infographic to drive this point home. Of those 20%, you have to find those who can (and will!) prospect effectively.

Now, you have to consider if you can actually get this person to come work for you.

Let’s pretend they like you, your company, your market, or something else. It does happen.

Can you get him or her at the price needed?

Salary or base is not the only price. Though if you find the right person, it’s often worth it (as you’ll see) to pay them what’s needed. Because there aren’t as many as you think.

Obviously we can look at equity or options or something else financial. And that may be a lure.

But there are other costs.

As a founder-owner, you may have to pay in time spent with them. Training. Coaching. Managing.

He or she may want some say in the strategy, future hires, or something else. (Don’t necessarily make too many promises here.)

Maybe he or she wants upward mobility.

But time is usually the biggest cost. And the one you need to be willing to pay to ensure this person succeeds.

Why?

Because most salespeople – the ones who will be the face of your company, the ones who will be listening to customers, the ones responsible for bringing in the dollars a company needs like oxygen – aren’t ready-made. At least not for your company. Especially when that company is doing something new.

This will be hard. Because you’ll invest a lot in this person. AND THEY MAY NOT BE WITH YOU FOREVER. Your first hire may not make it to year 5. Or 10. That’s ok. Because right now, your company needs customers and cash more than anything else. Pay for them. And know that the person who gets you there may not be your future VP, forever bestie, or one-day business partner. It’s ok.

There’s one more item to lay out here, one I’ve been noticing and thinking a lot about in the last 6-8 months. And I believe it’s the key success factor in hiring a seller early in a company’s life cycle.

With sales, there are a slew of skills that qualify as “selling skills.”

- Prospecting. This is finding an opportunity. You’re early stage? You need it.

- Account management. Usually reserved for selling repeatedly into a company, whether products or services. Probably not on your list yet.

- Consultative selling. This is working through complex, often ambiguous situations over a period of time. If you aren’t in a bidding situation, or a fast transactional scenario, you likely need some level of this.

- Discussing money and budgets. If you’re B2C, you don’t need it. Everyone else generally does.

- Getting access to right people. Selling B2B, and if the key people aren’t easily reachable, this needs to be on your list.

- Handling resistance. Do you have competition? Or a customer who doesn’t know they need your product? Or doesn’t have much budget? You need this.

- Selling against competition. This is more important when you have competitors. Which, if you’re successful, you will. But not yet.

- Selling against the status quo/doing nothing. This you probably need.

- Building relationships quickly. A few salespeople can get away without having this skill, but generally, it’s table stakes for your company. It helps to have likable people representing you to customers.

- Presentation skills. This doesn’t mean just a demo. It could be the ability to tell a story that is compelling.

That’s a quick list. But something’s missing.

Know this. You need the following in your first hire, per earlier:

- Work ethic.

- A bulldog-like ability to dig through accounts to find the right people, persist.

- Ability to handle rejection/failure without taking it personally.

- Intellect to think on their feet and generally solve problems.

- Posture. Great posture covers over several deficiencies. This is the ability to sit in front of someone, especially someone senior, hold your ground, push back, challenge, feel comfortable, make them comfortable, and move a conversation forward confidently.

Here’s the thing that you need for your early-stage startup selling something new that the market hasn’t fully adopted, or doesn’t yet know they need. (This applies to consultative sales, too, in established industries.)

- Mental elasticity

- Mental agility

Elasticity is connecting ideas, often by stretching from one understood framework, to another. It’s a comfort with ambiguity. It’s sitting in a situation, looking for the right moment that may not look, sound or feel like anything they’ve seen or rehearsed before.

Mental agility is a person’s deftness with a changing conversation, or landscape, depending on whom they’re talking with. Someone who may get into a deal via IT will have a different conversation if their entry point is marketing. Or sales. Or finance. Yes, that’s intellect, but many intelligent people can’t move between various fields or topics like that.

Let’s make a comparison. Here’s a football play as it’s drawn up. (If you’re interested, the formation is Trey Open Right, Gun Weak. The play is a form of verts, meaning all the receivers are going to get down field and not stop.)

This play is simple for the receivers: they go where they’re supposed to. Many salespeople can do that, especially in a well-scripted, choreographed sale that their manager has rehearsed with them ad nauseam. You should be thinking about the largest companies you know, because they can do this: make the sale straight forward.

But in the early days, your salesperson isn’t a wide receiver running a pattern.

Your seller needs to be a quarterback. And one like Johnny Manziel at Texas A&M. Plays are going to break down, and it’s going to be chaotic as they talk with potential buyers. They have to work through it to find reasons to do business, to get to the right people, to create opportunities where none seem to exist, and to close the deal. All while working with product, finance, and you.

He did that sort of thing all the time.

What do elasticity and agility look like in a seller?

The ability to pivot messaging from one meeting to another, sometimes even in the same meeting. It’s iterating through various customer pain points in a matter of days, not weeks or months. It’s conversing with different types of buyers on different topics, and honing in on common challenges. It’s having a willingness to wait and look for an opening in a conversation, though one that’s undefined.

Good product leads have this. Though getting them to jump into a sales role is a tall order.

You need it. It’s what you have as a founder and owner. And you’ll be frustrated with your hire until you have it in your salesperson.

So how do you find this person?

First, make peace with the fact that this person is rare. Remember those killer graphics? Here’s one more.

See that dark section in the middle? That’s what you’re sorting through every candidate to find. Not many out there.

But all is not lost. There’s hope, even if there are no clear cut paths.

You’re going to work hard. You’re going to need to look at more candidates than you’ve ever thought.

You need some identifiable markers.

- Someone who has worked in an early stage startup, even outside of sales can be good.

- Someone who has worked in other functions than sales (i.e. product, marketing) can be good because they have had to think through the business from other angles.

- Someone who has not come from a large company, or at least not come from a large series of companies is helpful.

Those aren’t deal-killers, but something I’d be looking for.

What else?

Assess. I’d likely use a combination of Culture Index (I’ve personally worked with John Conger to evaluate teams using CI) and Objective Management Group’s tools. They tell you different things, but remember, we’re seeking someone in the middle of a Venn diagram, so we need to know who can sell, and who can handle ambiguity. That’ll help you narrow the region of darkness.

But then you still have to vet this person. In your hiring process, look for:

- Problem solving ability. I’m not sure Google-like questions on the number of piano-tuners in Chicago help, but something practical might.

- Listening skills. Do they pick up on small asides you make in a conversation? Or loaded comments? Do they bring those up?

- How quickly they pick up new concepts and make connections as you explain them. Can they articulate to you what you’ve said in their own words?

- How they handle resistance. An audition or role play helps you to see this.

And when you go through all of this, and you feel like you have your person, be willing to pay what you need. In time and/or money. Definitely in time.

Will all your sales problems be solved?

Nope.

You’ll still need to sell, maybe for a long time. (There’s word of Larry Ellison of Oracle still getting involved in deals 20+ years into their journey.) No one can sell like an owner, and frankly, it’s the most important thing you do early.

But you’ll be able to start handing off elements of the sales funnel bit by bit. The collateral. The lead generation. The early qualification. All bit by bit.

Start with looking for that special seller who 1) has the right talent; 2) will do the hard work of prospecting; 3) will work for you; and 4) has the mental agility and elasticity your market needs today. Then vet them. Even when you worry you’ll lose “the one.” Don’t rush this hire. It’s too expensive to make up for the burned cash and lost opportunity. Take your time. Get the right hire. The one in the middle of those four overlapping circles.

It’ll pay off. But like your company, it may take a little longer and a little more investment to get it there.

Want to talk more about this? Email me at adam@thenorthwoodgrp.com.